Do you hold highly appreciated stock that you want to sell, but don’t want to pay the subsequent capital gains tax?

If so, there is a new investment option to consider. Investing in a Qualified Opportunity Fund (QOF) allows you to defer federal tax on your capital gains while freeing up the money you initially used to buy the stock (i.e., your cost basis) for other purposes.

In addition, this new investment opportunity has the potential to eliminate federal tax on up to 15% of your capital gains. Plus the additional possibility for your new QOF investment itself to be free of federal capital gains tax when you eventually sell the fund.

Sound too good to be true? Well, it is real, but there are drawbacks and lots of details to consider before investing.

What Is A Quantified Opportunity Fund?

This unique opportunity was created by the 2017 Tax Cuts and Jobs Act tax package passed by Congress to help spur economic development and jobs in distressed communities; presenting investors with a rare opportunity to reduce their tax burden outside of a qualified retirement account.

A Qualified Opportunity Fund (QOF) is an investment vehicle—corporation or partnership—set up to invest “in eligible property that is located in a Qualified Opportunity Zone.”

A Qualified Opportunity Zone (QOZ) is “is an economically-distressed community where new investments, under certain conditions, may be eligible for preferential tax treatment.” There are thousands of designated Opportunity Zones throughout the country.

Who Would Most Benefit From A QOF Investment?

One ideal candidate for a QOF investment would be someone who holds highly appreciated stock (and wishes to sell)—such as an Amazon or Microsoft employee who holds stock from vesting RSUs or exercised options and now wants to diversify their investments.

Another candidate would be someone who recently sold a business creating a significant long-term capital gain.

The critical component is that the investor needs to have sold the asset(s) within the prior 180 days and realized a long-term capital gain. And the sale needs to be outside of a qualified retirement account (401k, IRA, etc.) and not be the sale of their personal residence.

What Are The Benefits And Requirements Of A QOF Investment?

- Select a Qualified Opportunity Fund (QOF) that invests in businesses or real estate located in one of the thousands of areas throughout the country designated as Qualified Opportunity Zones (see list)

- Invest up to the amount of long-term capital gains realized within the prior 180 days

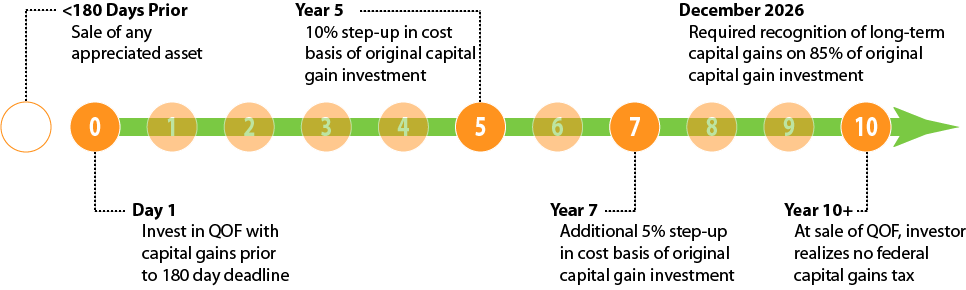

- Federal long-term capital gain tax on the amount invested is deferred until December 31, 2026 or until the investor sells the QOF, whichever comes first

- If you hold the investment for over 5 years, your cost basis is increased 10 percentage points (i.e., you invest $100,000 that was long-term capital gains, after 5 years, you would no longer owe federal capital gains on 10% of the $100,000; in other words $10,000 in gains would be erased for tax purposes)

- If you hold for an additional 2 years (7 years total), another 5 percentage points is eliminated (for a total of 15% reduction in capital gains when you eventually pay the tax man)

- Furthermore, any capital gains realized from the QOF itself are free from federal capital gains if held for at least 10 years (e.g., if the investment is sold for $200,000 after 10 years, the $100,000 in gains is free of federal capital gains tax)

An Example—How Does It Work:

Bill sells $500,000 worth of Microsoft stock that he received from previously vested RSUs. He has held all the shares for at least 1 full year past RSU vesting. And the cost basis (i.e., value at RSU vesting) is $200,000. Normally, Bill would owe long-term capital gains on the $300,000 increase in value, resulting in a federal tax bill of $71,400 (assuming he is in the 20% long-term capital gains bracket and pays the 3.8% Medicare surcharge).

But if he invests the $300,000 gain into a QOF within 180 days, he defers the tax and owes nothing at that time. [And he has also freed up the $200,000 of cost basis that he can now spend or reinvest elsewhere.]

If he sells the QOF within 5 years, he will owe the federal long-term capital gains that were deferred (i.e.,$71,400) at the time of sale. He has deferred the tax liability, but he still must pay.

But if Bill holds the investment for 5 year, 10% of the long-term capital gain that was reinvested in the QOF becomes tax free. His cost basis on the investment moves from $0 (since he only invested capital gains) to $30,000, on which he owes no federal capital gains tax when he sells.

Once Bill holds the investment for another 2 years (the 7 year mark), another 5% step-up in cost basis occurs, so now 15% of the initial investment is excluded from federal long-term capital gains.

If Bill continues to hold his QOF investment until the end of 2026, his deferral of federal capital gains ends and he owes tax on 85% (100% minus the 15% that have been excluded) of the original capital gains that were invested.

After 10 years from his initial investment date, Bill sells his investment for $450,000, resulting in a $150,000 gain on his $300,000 investment. But since he was invested in a QOF, Bill does not owe federal capital gains tax on this $150,000.

If this same investment was made outside of a QOF, Bill would have likely owed $71,400 on the initial sale of Microsoft stock and then another $35,700 on the sale of the subsequent investment. For a total tax bill of $107,100.

But by investing in a QOF, that tax bill potentially can be reduced to only $60,690—23.8% tax on $255,000 in gains (85% of the $300,000 in deferred gains). A potential savings of up to $46,410 in federal taxes while deferring any payment of tax until December 2026 (or until he sells the QOF investment, if sooner).

And if Bill’s total taxable income decreased (perhaps due to retirement) by the time taxes are finally due (i.e., when the investment is sold and/or the end of 2026), the long-term capital gains might end up being taxed at a lower rate than they would have been during his peak earning years—potentially saving Bill even more money.

To summarizes, three basic tax benefits:

Defer federal long-term capital gains for up to 8 years (until end of 2026). Capital gains realized from the sale of any appreciated asset can be “reinvested” into a QOF within 180 days and no federal capital gain tax will be owed until December 31, 2026 or when the investment is sold, whichever comes first.

Permanently exclude 10% or 15% of the deferred capital gains. If the QOF investment is held for longer than 5 years, 10% of the deferred gain becomes tax free. If held for more than 7 years, the 10% becomes 15%.

Opportunity for QOF to grow tax free. If the investor holds the QOF investment for at least 10 years, the investor is eligible for an increase in basis of the QOF equal to its fair market value on the date that the QOF investment is sold. In other words, you would owe no federal capital gain tax on the QOF investment itself.

How Are QOFs Structured? What Investments Can They Hold?

A QOF can be organized as a partnership or a corporation. The fund must hold at least 90 percent of its assets in property located in a QOZ. Details on the exact types of investments/property that qualify are complex (and beyond the scope of this posting); specific details are still being worked out by the IRS. For more information, you can read the proposed IRS rules in the Federal Register (Investing in Qualified Opportunity Funds).

Significant Drawbacks to QOF Investments

Although an investment in a QOF can offer some enticing tax benefits, there are some important caveats to keep in mind.

- By the nature of the investment, it is likely that a Qualified Opportunity Fund will require a long term commitment and be illiquid. Hence, if you potentially need the money within the next few years, this would be a poor investment option.

- In order to realize the tax free appreciation of the QOF investment, you must hold for at least 10 years. But the deferral of the capital gains tax only lasts until December 31, 2026 (or when the QOF is sold, if earlier). Given it is already January 2019, it isn’t possible to hold the fund for 10 years (in order to qualify for the increase in cost basis) and sell the fund before the end of 2026. Hence, if you want to hold the investment for 10 years to realize the fully tax benefit, you will need to come up with additional cash to pay the capital gains tax bill that will come due at the end of 2026.

- Need to invest in a QOF by the end of 2019 to realize the full tax benefit. You must hold the QOF for 7 years to trigger the final 5% reduction in your taxable capital gains on the reinvested funds, but the tax deferral only lasts until the end of 2026. So if you don’t invest by the end of 2019, you won’t have 7 years available before the deferral ends.

- Don’t let the “(tax) tail wag the (investment) dog.” The tax savings available are unlikely to make up for a suboptimal investment outcome. The underlying investment should be a suitable and reasonable investment in the first place; requiring the same due diligence as any other similar investment. It would take only 2-3 percentage points difference in annual investment return to negate the tax benefit, and that assumes you hold the investment for 10+ years. It would take even less of a difference in annual return if you sell before the 10 year mark (and not trigger the cost basis reset).

- Investors will likely need to be “Accredited Investors”—generally meaning you must have a net worth of over $1 million (exclusive of residence) or income in excess of $200,000 individually or $300,000 jointly with a spouse. In addition, most funds will likely require a minimum investments of at least $100,000, if not substantially more.

- Unclear how the QOF investment benefits mesh with other tax provisions, such as, the step-up in basis on death (i.e., no capital gains tax on inherited property) and depreciation of commercial real estate. Loss of these tax benefits could outweigh the benefits from a QOF investment.

Maybe a Good Investment, Maybe Not

If you find a promising QOF, it may be a good way to save on taxes while helping revitalize underserved communities. That being said, there are significant caveats and drawbacks to these investments. As with all investments (and especially unregistered funds), full due diligence is recommended on the underlying investments and the fund management. These funds may be marketed based on the tax benefits, but the tax benefits alone are unlikely to make up for a poor investment thesis.

Resources:

https://www.irs.gov/newsroom/opportunity-zones-frequently-asked-questions

https://www.kitces.com/blog/qualified-opportunity-zone-qoz-fund-qof-defer-avoid-capital-gains/