We have data to answer this question thanks to the Department of Labor (DoL). 401(k) plan sponsors are required to file Form 5500 with the DoL every year.

Form 5500 lists which investments Microsoft 401(k) plan participants have selected for their retirement funds—giving us insight into how Microsoft employees choose to invest for retirement.

So, what do Microsoft employees invest in?

Shares in Microsoft stock (MSFT) are one of the largest investments across Microsoft plan participants, with 10% of total plan assets (up from 8% back in 2017, due to the 300%+ gain during this period). This represents the third most popular holding with $4.8 billion in value.

Microsoft employees hold less company stock than many other technology companies that offer their stock as a 401(K) investment options. This is likely because since 2016 the investment of new contributions into Microsoft stock within the plan was discontinued. Hence, all gains are from price appreciation and potentially the reinvestment of dividends.

The single largest holding by plan participants is the Fidelity Growth fund with $5.4 billion in assets, barely capturing first place with 11% of total plan assets. This commingled pool seeks to “provide capital appreciation over a market cycle relative to the Russell 3000 Growth Index through the active management of equities.”

Coming in second place—also with 11% of plan assets—is the low-cost Vanguard S&P 500 Index Trust. This fund tracks the performance of the S&P 500 Index, representing around 500 of the largest companies in the United States—a great choice for a core investment holding.

Fourth, fifth and ninth place are BlackRock LifePath target retirement funds.

These funds are designed to shift their holdings as the target retirement year approaches. They gradually shift to more bonds and fewer equities. In other words, they become more conservative as time passes.

The largest of these holdings is the LifePath Index 2040, designed for people planning to retire around the year 2040.

Plan assets as of 12/31/2021

(From Microsoft’s July 2022 filing of Form 5500)

| Investment | % |

| Fidelity Growth Company Pool Class 3 | 11% |

| Vanguard S&P 500 Index Trust | 11% |

| Microsoft Common Stock | 10% |

| BlackRock LifePath Index 2040 | 7% |

| BlackRock LifePath Index 2050 | 7% |

| Fidelity Contrafund Pool Class 3 | 6% |

| Artisan Mid Cap Account (SMA) | 5% |

| Vanguard Russell 1000 Growth Index Trust | 5% |

| BlackRock LifePath Index 2030 | 4% |

| Vanguard Russell 1000 Value Index Trust | 3% |

| Vanguard Russell 2000 Growth Index Trust | 3% |

| PIMCO Total Return Account (SMA) | 3% |

| All other | 24% |

| Total Assets (excluding participant loans) | 100% |

See the Microsoft 401(k) page for additional plan details and value of holdings.

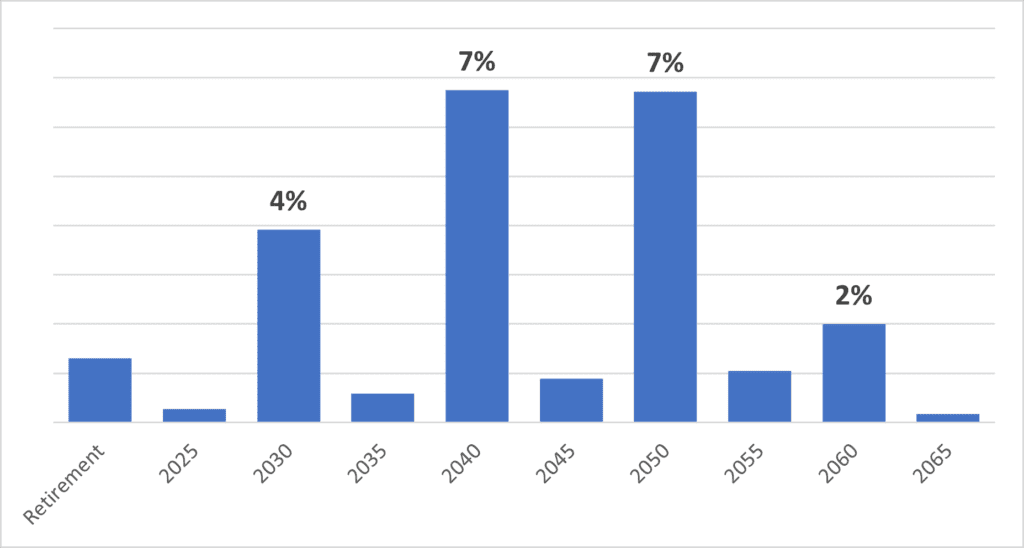

Retirement Distribution

The distribution of assets in LifePath Index target retirement funds—which represent about a quarter of total plan assets—provide a rough view of participating employee ages.

The largest holdings are in the LifePath Index 2040 and 2050 target funds. These investments should represent employees who plan to retire in the next 20 to 30 years.

Source: 2021 Form 5500 for Microsoft’s 401k plan