-

12 Oct '20

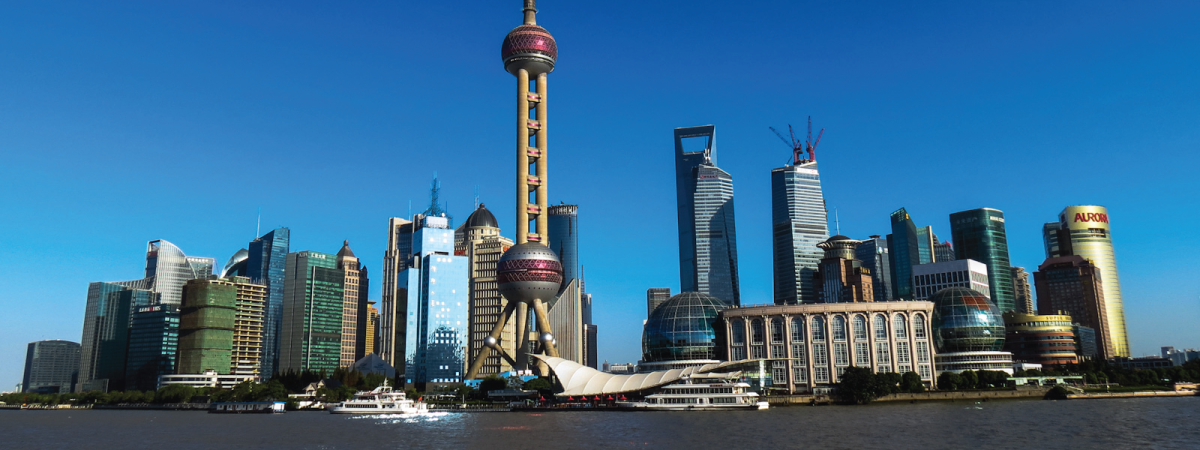

Should I Invest Internationally?

Continue readingInternational stocks have been crushed by U.S. stocks over the past decade—and the return from developed international markets has barely outpacing inflation over the past 20 years. Leading some investors to question if they should own foreign equities given this poor performance. For a variety of reasons, we still believe U.S. investors should maintain exposure […]

-

28 Sep '20

Are TIPS a Good Investment – Inflation Hedge Series

Continue readingWith the Federal Reserve “printing” massive amounts of new money to fund Congress’s record-breaking deficit spending, I thought it would be a good time to review investments considered good hedges for inflation. Ideally a good inflation hedge would maintain (or increase) its real value during periods of high inflation. Today’s post will consider Treasury Inflation-Protected […]

-

17 Sep '20

Are Amazon and Google technology companies?

Continue readingWhen you think of large technology companies, you probably think of companies like the so-called FAANG stocks: Facebook (FB), Amazon (AMZN), Apple (AAPL), Netflix (NFLX), Google (GOOG). Not a bad starter list of highly successful “tech” companies. But from an investing standpoint—of the 5 FAANG stocks—only Apple Inc. is considered part of the Information Technology […]

-

31 Jul '20

Target Date Retirement Funds

Continue readingThe most common investments in many tech company 401k plans are target date retirement funds. These funds provide employees with exposure to a diversified investment portfolio that systematically shifts out of risky asset classes (like stocks) and into less volatile investments (like bonds) as you get older and closer to retirement. Firms like Amazon.com and […]

-

10 Jul '20

A Recovery for the Ages

Continue readingMost risky assets staged a dramatic recover in the second quarter of 2020. The S&P 500 index (large U.S. stocks), MSCI EAFE index (developed markets international stocks) and the MSCI Emerging Markets index all bounced of year-to-date lows set on March 23. The Russell 2000 index (small U.S. stock) shined among the equity indices by […]

-

08 Apr '20

Now What?

Continue readingNow What? Stay calm and do nothing. With global stock markets tumbling and an extreme level of uncertainty around the future, human nature is act, to do something, to intercede, to make things better. Yet as a long-term investor, you are often best served by doing nothing different (or very little). Just let your investment […]

-

23 Mar '20

Five Predictions For 2020

Continue reading2020 Predictions The Chinese stock market will outperform Berkshire Hathaway will cut several deals with distressed companies at bargain prices Top line shines, margins suffer for diversified retailers (grocery) The Fed will nationalize an additional $5+ trillion of the national debt Extraordinary government programs to bailout small businesses With large swaths of the global […]

-

17 Mar '20

Demand in the age of Coronavirus

Continue readingThe economic shock delivered by the COVID-19 pandemic has been swift and severe for capital markets. In only a few short weeks many market indices are down 30-40% from recent highs. These large declines in stock prices reflect Mr. Market factoring significantly lower corporate earnings in the future (and a large amount of uncertainty). So, […]

-

04 Jan '20

Decade in Review

Continue readingU.S. Large Stocks Dominate Investing this past decade has been defined by a long bull market rising from the ashes of the Great Financial Crisis of 2007-2008. The current bull market—defined as a generally increasing stock market without a 20% decline—is now almost 11 years old, the longest in U.S. history. Like other bull markets, […]

-

24 Oct '19

How the USA will default on the national debt

Continue readingOnce upon a time, politicians paid lip-service to the idea that our country should operate with some semblance of fiscal responsibility. It’s almost comical to look back at Ross Perot’s presidential runs in 1992 and 1996 when he used flip charts to rally against government debt. Back then the United States had a national debt […]

-

04 Oct '19

Are Bonds Still A Good Bet?

Continue readingWith bond yields near generational lows, it raises the question: is it still worth owning bonds? Given the risk-return offered, are bonds still prudent for long-term investors within a broadly diversified portfolio? For most portfolios, bonds provide “ballast” helping to stabilize the generally more volatile returns from stocks. Historically, bond returns have been lower than […]

-

03 Jun '19

Player or Investor?

Continue readingAs an observer of the capital markets over the past few decades, I’ve noticed that “market professionals” and investment advisors are generally selling a story about the future. Whether a bold prediction on the future price of gold or a more subtle discourse on why it’s a good time to buy Tesla, Uber or Apple. […]